Retirement Solutions 4 Life Inc.

Call Today: +1-941-239-3048

Medicare! The long awaited insurance plan you've waited for all your life, or not? There are many choices when it comes to Medicare. The single, most important choice when enrolling, is do you choose medicare advantage or medicare supplemental plan?

Not sure of the difference? Medicare advantage plans are more like HMOs. Medicare supplemental plans are more like a PPO plans. Well, how PPO plans used to be when they existed, prior to Healthcare Marketplace. As an independent agency, we can offer an array of services and a tailored experience.

If you're turning 65, you are in what is considered open enrollment. Open enrollment means, you are guaranteed a policy, no health questions to answer. Medicare alone, may not be enough to cover all expenses. The chart below shows the most common types of care received, and how the expenses are usually covered. With the right plan, we can ensure most of all Medicare approved expenses are covered. Call or contact our office for a free medicare consultation.

Long Term Care

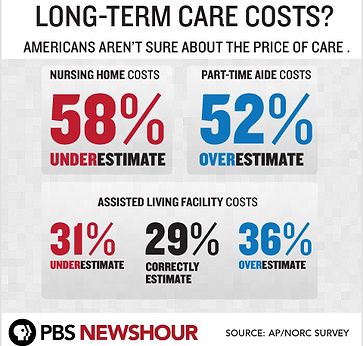

This in our opinion, is one of the most overlooked and avoided topics in retirement plans. Even if you were the smartest investor, saver, the most knowledgeable, failing to have the proper Long Term Care plans and the wrong, unfitted Medicare policy, can financially devastate a lifetime of savings in a matter of months, depending on the size of savings. Reports show, and can also be found in the Medicare Guide issued by the Social Security Administration, and even states factually, there is a 3 out of 4 chances someone will need this type of care at some point in their life. However, most, haven’t discussed or even thought of the possible scenarios that can happen, the cost, and what legal obligations there may be for a loved one’s family. The cost of this type of care continually increases, as life expectancies are also longer, therefore, making the probability of needing this care, even higher as time passes. Nearly 70% are going to need some Long Term Care at some point as of 2025. Oftentimes, many think they are "too young" or "will wait until needed". The best time to discuss this topic and create a plan is before it’s too late. How soon is too late? It’s a roll of the dice. Do not gamble with your health, or with your very hard earned savings. Call or contact us at

Our office for a free-no obligation policy quote review. Some newer policies and products pass on to your heirs if you don’t use it. It’s better than auto insurance, in our opinion.

What?! You don't want to go to a facility? You and a million others! We've heard from numerous families, that Mom, made them promise that she won't go into a facility. The only way to guarantee that is with a policy!

Most are unfamilar with long term care. Often times, it is found the first time someone learns about long term care, is when they or a loved one is being released from a hospital, in which case, it's already too late to do anything about it. "I think it's because a person gets so far in life, only to find out there's another insurance policy, they're supposed to have, and they feel like, oh great! another insurance premium! I don't think it has to feel that way! We do feel, if we as a community and society continue to ignore that fact, the government will step in and regulate, like they have with healthcare. In my opinion, that won't be good. It's already in the Guide to Medicare book they publish." says Vicki Guy Founder of Retirement Solutions 4 Life Inc.. Be proactive. Educate yourself. Let's discuss some facts.

The cost of care varies based on your geographic location, but here are some average costs of care, based in Florida, give or take a few dollars:

One of the biggest reasons we find people generally don't have a long term care policy, is because they do not want to go to a facility. The truth is, 82% of people receiving long term care are not in a facility, and only 18% receiving this type of care are living in a facility. Long term care policies cover in-home care, if the policy is designed properly. The other main reason, is because quotes previously received were too expensive. Retirement Solutions 4 Life Inc., is an independent agency which provides you the freedom to tailor your policy

So, 75% of those over 65 years old are going to need long term care & only 29% correctly estimate the cost of care.

within your budget. Did you know that the premiums paid for long term care can also be tax deductible? Please do not wait until it's too late, contact our office for a free quote and consultation. Its the best thing you can do for you and your family. It may be, the one thing, that guarantees you get to stay at home and out of a facility.